[ad_1]

Our experts answer readers’ investing questions and write unbiased product reviews (here’s how we assess investing products). Paid non-client promotion: In some cases, we receive a commission from our partners. Our opinions are always our own.

Online financial advisors are more accessible, and often cheaper, than human advisors who actively manage investment portfolios. They’re a good option for beginner investors and hands-off investors at any wealth level.

For this list, we didn’t consider companies that match clients and advisors for comprehensive financial planning services, such as Zoe Financial or Facet Wealth. Instead, we focused on tech-driven firms where you can access an automated and personalized portfolio and consult a professional for advice when you need it.

Best Online Financial Advisors

Compare the Best Online Financial Advisors

SoFi Automated Investing

SoFi Invest is one of the best investment apps and the best investment apps for beginners. It’s a great platform for US investors who are looking for an intuitive online trading experience, an open active or automated investing account, and assets like cryptocurrencies.

Account Minimum

$1 ($500 for automated investing)

Fees

$0 for stock trades. 0.25% for automated investing (0.06% to 0.13% for fund fees)

Investment Types

Stocks, fractional shares, ETFs, index funds, and crypto trusts

Wealthfront Investing

Wealthfront is one of the best robo-advisor options if you’re in search of low-cost automated portfolio management, and one of the best socially responsible investing apps for features like tax-loss harvesting, US direct indexing, and crypto trusts.

Details

Account Minimum

$1 ($500 for automated investing)

Fees

$0 for stock trades. 0.25% for automated investing (0.06% to 0.13% for fund fees)

Account Minimum

$0 to open, $10 to start investing ($100,000 for premium plan)

Fees

0.25%/year for digital plan; 0.40%/ year for premium plan; 1%/year for crypto portfolios

Investment Types

ETFs and cryptocurrencies

Betterment Investing

Betterment is best for hands-off investors who want to take advantage of professionally built, personalized ETF and cryptocurrency portfolios. The platform offers CFP access, so it could suit those in search of additional guidance from human advisors.

Details

Account Minimum

$0 to open, $10 to start investing ($100,000 for premium plan)

Fees

0.25%/year for digital plan; 0.40%/ year for premium plan; 1%/year for crypto portfolios

Account Minimum

Varies by account

Fees

$500 annual advisory fee, 2% AUM

Investment Types

stocks, bonds, mutual funds, ETFs, UITs, structured notes, options, alternative investments

Ameriprise Financial Investments

Ameriprise Financial Services is a brokerage and financial advisory firm best for experienced, passive investors interested in using the site’s financial planning services, wealth management tools, and fiduciary advisor access.

Details

Account Minimum

Varies by account

Fees

$500 annual advisory fee, 2% AUM

Online Financial Advisors Frequently Asked Questions (FAQs)

The best financial advisor depends on what you’re looking for. Someone seeking comprehensive and personalized advice and a low-effort investment approach should consider SoFi Automated Investing, which creates a custom portfolio aligned with your goals and offers no cost sessions with certified financial planners. For investors with balances over $100,000, a good option is Betterment, which offers goals-based portfolios and complimentary, ongoing financial advice.

Financial advisors who are providing financial advice often charge by the hour, typically between $100 to $300. Advisors who are creating a comprehensive financial plan tend to charge a flat rate between $1,000 and $3,000. If you hire an advisor to manage your investment portfolio you’ll be charged a percentage of your account balance, typically between 1% and 3% annually. While that’s much higher than the fees that the best robo-advisors charge, you get the added benefit of being able to build a relationship with a trusted source who can adjust your strategy as needed, provide personal recommendations, and answer questions when they arise.

Many traditional financial advisors require clients to have at least $100,000 in an investment account before they’ll manage it. Many online financial advisors (or robo-advisors) have no minimums. If you’re looking for financial advice only, many advisors don’t care about a minimum net worth, income, or investment balance as long as you can afford their fee.

Not everyone needs a financial advisor — human or otherwise. However, you should consider paying a financial advisor if you need specific advice on your finances or investment strategy or you’re too overwhelmed or confused by your money to plan for retirement or invest in the stock market.

A financial advisor is a catch-all term that includes financial planners and investment advisors. Most online advisors offer both investment management — whether it’s carried out by a human or a sophisticated computer algorithm — and financial planning services or tools. Certified financial planners, or CFPs, are trained extensively in several areas of financial planning, including retirement, taxes, insurance, and estate planning. They also abide by the fiduciary rule, which means they’re legally obligated to put their clients’ interests ahead of their own and their firm’s. All CFPs must be fiduciaries, but not all fiduciaries have to be CFPs.

The best financial advisors follow the fiduciary rule, meaning they operate in their clients’ best interest, and are fee-only. This means client fees are their only compensation and they don’t earn commission when you invest in certain funds or buy financial products.

Best for Low Fees

Investment account types: Individual and joint taxable brokerage, traditional IRA, Roth IRA, and SEP IRA.

What stands out:

- Zero advisory fees

- Free one-on-one consultations with CFPs, a service that isn’t offered by some robo-advisors that charge an annual fee

- Portfolios invest in both SoFi ETFs and non-SOFI ETFs

- Account includes portfolio rebalancing and goal planning

- Investors get to choose between five portfolios: moderate, moderately conservative, conservative, moderately aggressive, and aggressive

- Additional SoFi membership perks include loan discounts and career counseling

- 4.1/5 Google Play store rating

- 4.8/5 Apple App store rating

What to look out for:

- No tax-loss harvesting

- Portfolios, while broadly diversified, are limited to 10 options

Best for Diversified Investing

Investment account types: Individual and joint taxable brokerage, traditional IRA, Roth IRA, SEP IRA, inherited IRA, and trust.

What stands out:

- Premium plans come with unlimited access via phone and email to Betterment CFPs

- Open an FDIC-insured cash account*

- Invest in socially responsible portfolios; cryptocurrency portfolios available

- Get free checking and cash reserve accounts (nice feature for recurring deposits into investments)

- Use goal-setting, advice, and retirement planning tools

- Link various accounts to clear and easy-to-use financial dashboard

- Buy one-off financial advice packages at standard industry rates

- Automatic rebalancing and tax-loss harvesting

- 4.5/5 Google Play store rating

- 4.7/5 Apple App store rating

*Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. Learn more.

What to look out for:

- Accounts with a $100,000 balance can upgrade to get advisor access, but the annual fee increases from 0.25% (an industry low) to 0.40%

Best for 529 Plans

Investment account types: Individual and joint taxable brokerage, traditional IRA, Roth IRA, SEP IRA, trust, and 529 college savings plan.

What stands out:

- Only top online advisor to offer 529 plans

- Invest in cryptocurrency trusts

- Borrow up to 30% of your investment balance at a low interest rate with a portfolio line of credit

- Open an FDIC-insured bank account

- Invest in socially responsible portfolios

- Get personalized recommendations with smart financial planning software

- 4.5/5 Google Play app rating

- 4.8/5 Apple App store rating

What to look out for:

- On-staff financial advisors don’t offer personalized advice

Best for Financial Planning and Personal Development

Investment account types: Individual taxable brokerage, traditional IRA, Roth IRA, and SEP IRA (all held at Folio Investments).

What stands out:

- Get an investment strategy built around women’s unique needs and challenges

- Access an extensive library of content and advisor-led workshops

- Invest in socially responsible portfolios

- Get monthly progress reports

- 4.3/5 Google Play app rating

- 4.7/5 Apple App store rating

What to look out for:

- Financial coaching costs extra (but members get 30%-50% off)

- Upgrade required for access to retirement account management

Best for Retirement Saving

Ameriprise Financial Investments

Investment account types: Three managed account options that can be opened as an individual brokerage account, traditional IRAs, Roth IRAs, Simple IRAs, SEP IRAs, 401(k)s, 403(b)s, 529 plans, and Coverdell education savings accounts (CESA).

What stands out:

- Best for experienced investors looking for advanced charting and investing features

- Access to fiduciary financial advisors to consult or manage your account

- Trade through online brokerage, over the phone, or with a registered service representative from Ameriprise’s client service center

- Offers stocks, bonds, mutual funds, ETFs, UITs, structured notes, options, and multiple alternative investments

- One of the largest registered investment advisors (RIAs) in the US

- 4.1/5 Google Play app rating

- 3.2 Apple App store rating

What to look out for:

- High account minimums (varies by managed account option)

- Hard to navigate website

- Complex fee structure

Ameriprise Financial Services review

Other Online Financial Advisors We Considered

- Vanguard Digital Advisor: You can think of Vanguard Digital Advisor as Vanguard’s second robo-advisor offering. The difference between Vanguard Digital Advisor and Vanguard Personal Advisor Services comes down to fees and human advisor access. Though you’ll pay less for Vanguard Digital Advisor ($3,000 minimum deposit and a 0.20% annual fee), you won’t be able to utilize personalized support from a professional financial planner.

- Empower Personal Dashboard™: Empower offers competitive robo-advisor services. The investment app also gives you access to human financial advisors, and it offers account features like tax-loss harvesting, single stock diversification, Retirement Planner, and more. The biggest drawback is cost. You’ll need a minimum balance of $100,000 to get started, and you’ll pay between 0.49% and 0.89% in management fees.

- Charles Schwab Intelligent Portfolios: This advisor offers several attractive features, least of which is a $0 advisory fee. But you’ll need at least $5,000 to get started, and you won’t have access to Financial Planners (though you will have access to professionals who can answer customer service and investing/portfolio questions) unless you upgrade to the premium service, which requires a balance of $25,000, a one-time planning fee of $300, and a monthly fee of $30.

- Fidelity Go: Created as Fidelity Investments’ robo-advisor offering, Fidelity Go provides low-cost automated investment management and expense ratio-free funds but doesn’t offer tax-loss harvesting. There’s a tiered pricing structure that charges 0.35% for balances above $50,000. And you won’t be able to consult human advisors unless you upgrade to Fidelity Personalized Planning & Advice, which requires a $25,000 minimum and 0.50% annual fee.

- E-Trade Core Portfolios: E-Trade’s robo-advisor charges a reasonable annual fee of 0.30% on all balances (with a $500 minimum), but doesn’t offer tax-loss harvesting. While E-Trade Core Portfolios’ customer service is strong, investors have no access to human financial advisors.

Find a Financial Advisor Online

How to Find an In-person Financial Advisor

You can also meet with an expert in person for financial guidance. So if you prefer to meet face-to-face, here are some tools to find some in your area:

Why You Should Trust Us: How We Reviewed The Best Online Financial Advisors

We compared a long list of Registered Investment advisors (RIAs), weighing the following five categories equally:

Fees: What are the costs (i.e., expense ratios, trading fees, advisor fees)? Are they justified when considering the services offered? What is the minimum balance for an investment account? Is it accessible for beginners?

Investment selection: What is included for the cost? Is there a good variety of investments to choose from? What else do you get working with this company (e.g. savings or checking accounts, budgeting tools, financial advice)?

Access: Who can use the service? How easy is it to navigate the platform, and are educational resources and/or human advisors available? Is it limited to a certain geographic location or available nationwide? Can you access your account via mobile app?

Ethics: Are the experts Certified Financial Planners and/or fiduciaries? Does the company have any disciplinary history over the past three years? What is the company’s investing philosophy? How is its legal standing, and how does the Better Business Bureau rate it (if its BBB profile exists)?

Customer service: Which forms of customer support does each platform offer? Is phone support available? Does it offer 24/7 service? Is live chat available, and can you use any other quick methods of getting in touch?

See our complete methodology for rating financial platforms »

[ad_2]

Source link

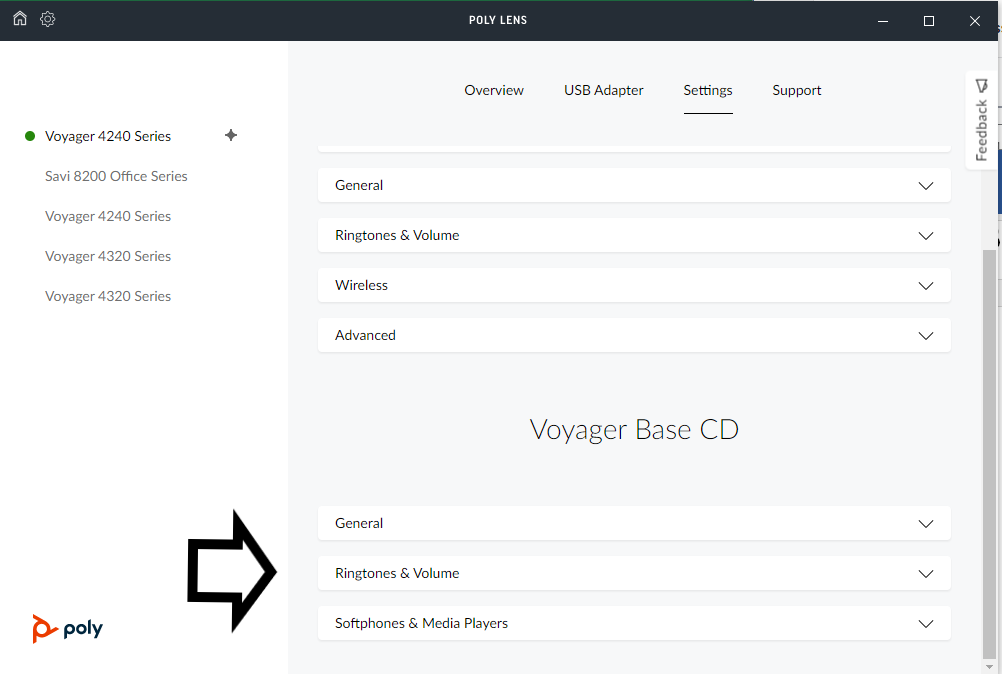

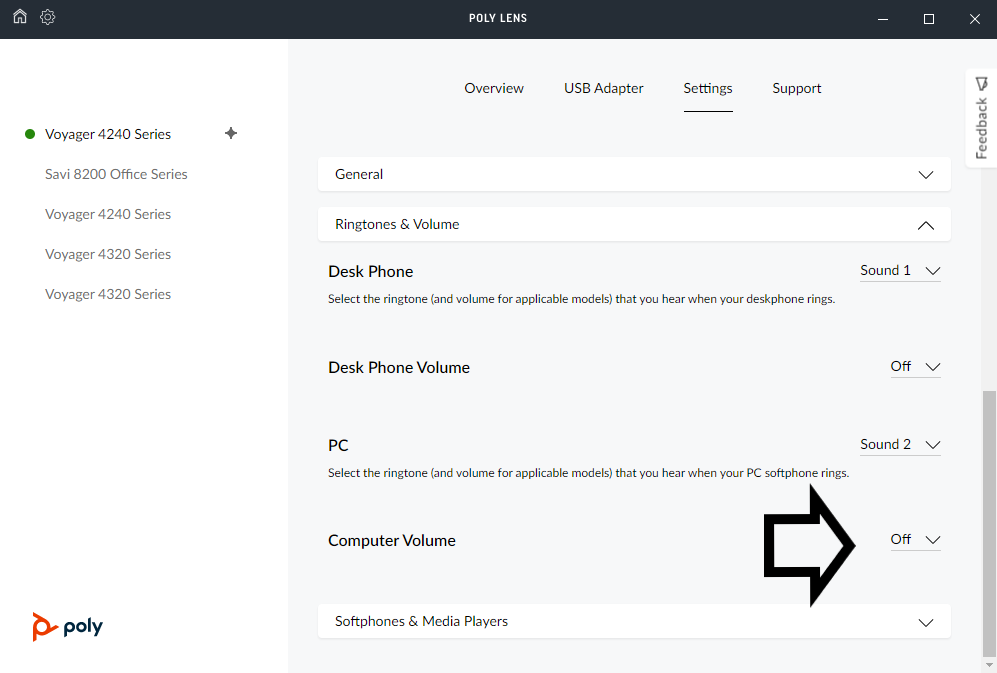

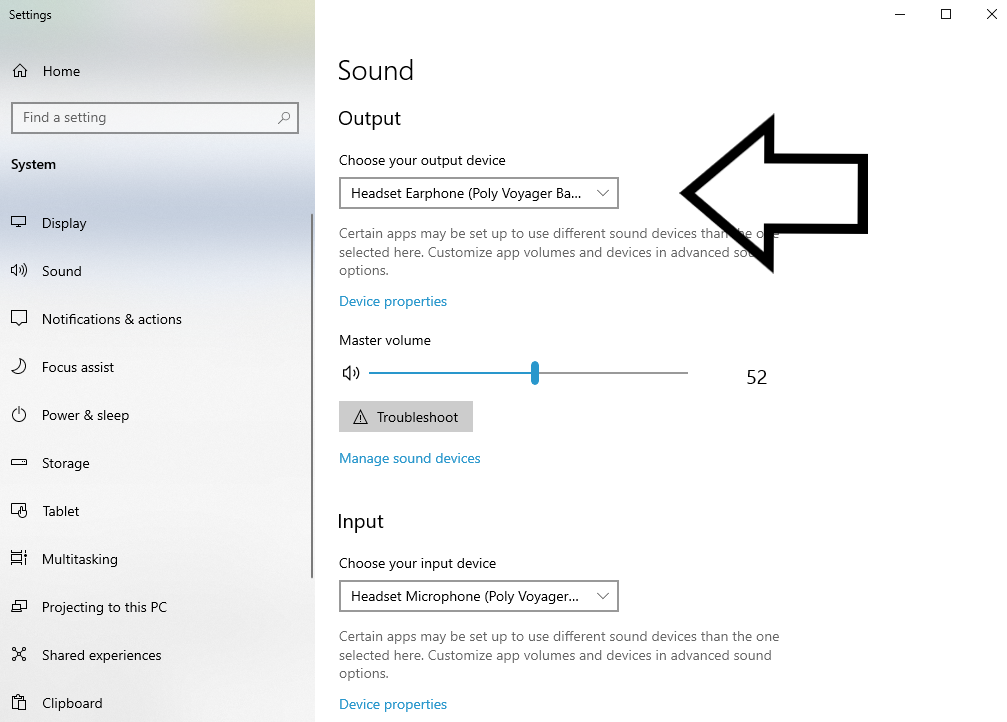

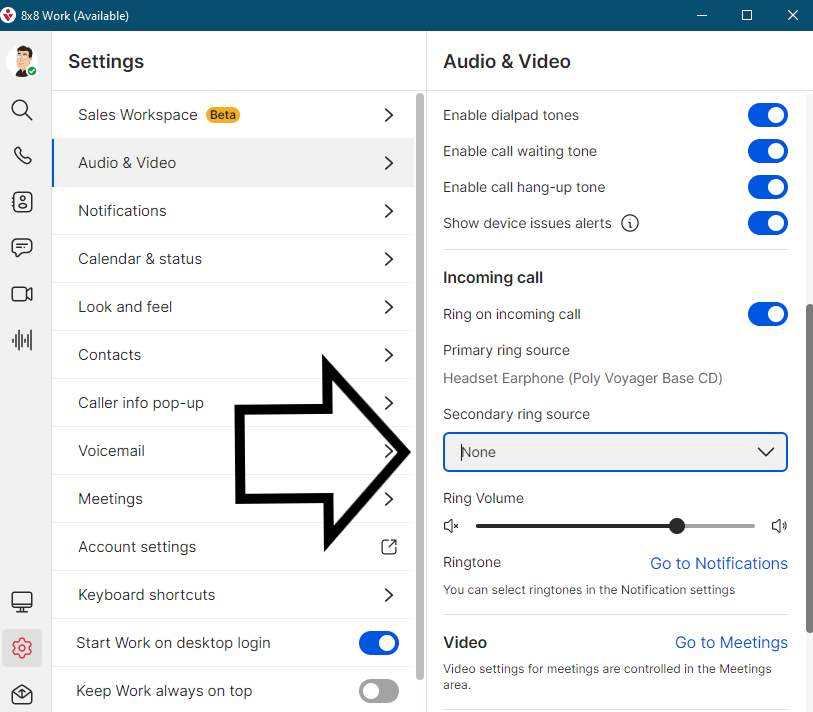

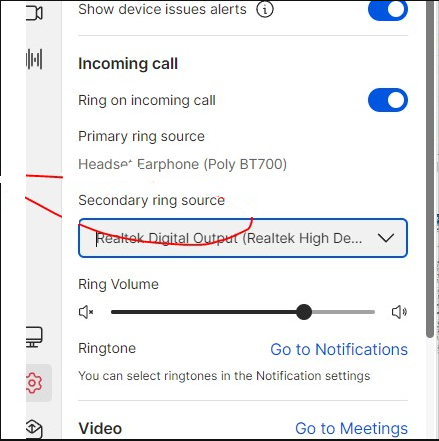

A. Using a Savi Office or a Voyager Office wireless headset.

A. Using a Savi Office or a Voyager Office wireless headset.