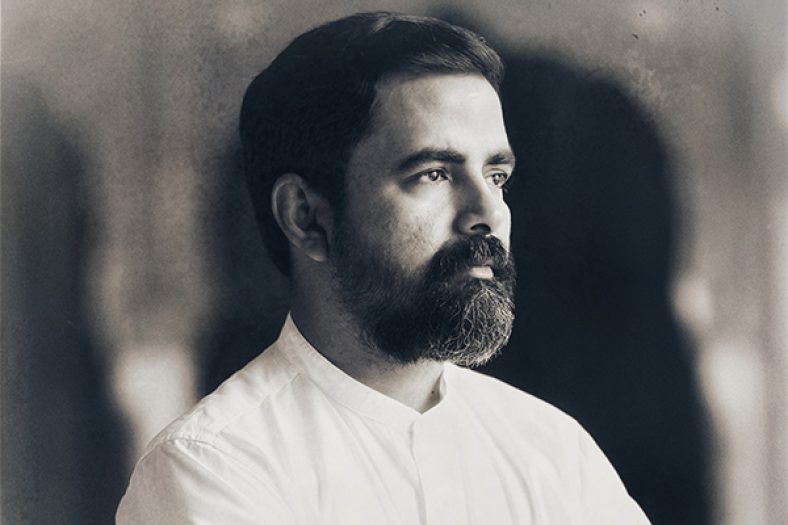

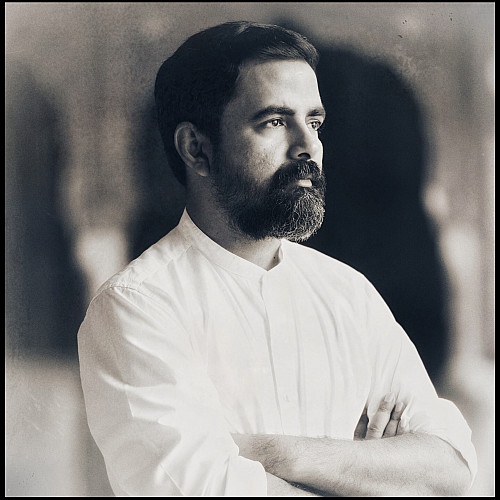

Photograph: Sabyasachi Mukherjee/Facebook

I have always been intrigued by the fact that Sabyasachi Mukherjee never considered moving out of the City of Joy to the Maximum City. With the opening of his newest store, he has instead, in some way, transported his hometown to the teeming metropolis of Mumbai. When I entered through the cavernous doors, glancing at the gleaming word “Sabyasachi” above the entrance, for the first time, I missed the “Mukherjee”. A few steps inside the multi-chambered space, three reclining brass tigers stood guard on either side of a narrow, thickly carpeted hallway. Strains of folk Rabindra Sangeet wafted in, and a polite staff member, wearing a black bandhni sari, enlightened me about the fact that the music too had the design maestro’s personal touch. As I turned a corner, where a wooden cabinet was neatly ensconced, I noticed a sindoor-red bucket bag with a wide cloth strap embossed with the word “Calcutta” in bold lettering.

Sabyasachi, I know, is the brand. I’m told by an early landlord and crafts enthusiast that his very first store in Mumbai was apparently self-consciously called “Sabyasachi by Sabyasachi”, which was abbreviated approximately within a year to “Sabyasachi”. It had felt okay, seeing just the first name on the front-page ads — that announced that the new store is open in Mumbai, seven days a week — in the The Times of India. But, without the “Mukherjee” across the facade of the store — which is a sort of a homecoming that celebrates everything that the designer adores about Kolkata — it occurred to me that he had actually created a vacuum, a kind of distance between himself and his label.

Is the 49-year-old designer actually ready to hyphenate himself, I wondered, as I wandered the space. The global brand, and luxury house, with stores dotted across continents, and cities — New York, Dubai, Hyderabad, Kolkata, Delhi and Mumbai — on one hand and the bespectacled, reserved, Alipore-residing Bengali Brahmin on the other. Throughout the store, I encountered poetically written plaques with inscriptions of personal odes, to old-time haunts like the grand tea room and cabaret at Firpo’s and the company of Presidency College and Bengal School of Art students. That the logo has been customised to carry “Calcutta” underneath it for print ads in magazines is then understandable.

Mukherjee’s spoken English too discloses that mildly lilting Bengali cadence with the rounding of the vowels. It’s endearing coupled with his innate shyness. Is this an affectation, now serving as just a marketing ploy? Given his enormous business acumen, is he more marketing genius than intellectual creative, some ask. Looking at his immaculate appearance, mostly dressed in his own pristine sherwanis, bandis, kurtas and churidars, an occasional shawl or scarf rolled around his neck, he seems to fit perfectly into that hallowed club of the cultured elite or babumoshais. Kolkata’s own intellectual culturati who have cut their teeth on the likes of Thackeray and Proust. So, I was least surprised to see Sabyasachi jewellery and accessories rubbing shoulders with leather-bound tomes within the library-styled nooks of the store. A copy of Charles Dickens’ The Pickwick Papers with antique gold lettering and a burgundy cover stood out.

Ah! The bhadralok. The Bengali word that best describes its educated class. Think of fellow kinsperson, Nobel Laureate Abhijit Banerjee, who paired a velvet bandhgala with the traditional dhoti-panjabi — the latter being a knee-length kurta made of cotton or silk — when he attended the Swedish awards ceremony in 2019.

Known to be reclusive and antisocial, and choosing to stay behind the scenes, the retailer and couturier seems to prefer that his roots are felt more through the ambience and mood, so vividly expressed in the much-talked-about interiors of his newly minted flagship store, housed in a neoclassical building. While describing the sprawling space, he says in a recent interview to fashion journalist Suzy Menkes, who flew down for the mega opening, that it’s like bringing the customer into his home. The same soft-spoken store staff member admits in genteel fashion to me that a cleaning staff, comprising 40 to 60 members, rotate in two shifts to ensure that the space crowded with bric-a-brac is kept spotless, and the glass-fronted armoires and gilded mirrors are always shining.

Kolkata’s old-world charm allows a specific brand of nostalgia wrapped up in aristocratic glamour to creep into his work everywhere — his photography campaigns, styling overtones, choices of models. And, most recently of all, the new bari (home) where his exquisitely crafted creations take centre stage: ICP Fort Heritage, the erstwhile British Bank of the Middle East; a Grade II A heritage structure, built in 1913 in the Italianate tradition, located off Horniman Circle. Luxury’s latest address in the city. The Ballygunge boy, who always harboured a fascination for all things larger-than-life, grew up to adopt a maximalist approach, both in his creations and the interiors of his eponymous stores. There is a lavish excess that is visible in his wall-to-wall aesthetic that has become so popular, and there isn’t an inch of space that isn’t crammed with clusters of antiques and curiosities, many that he has hand-picked. It doesn’t come as a surprise to find out that early on, the designer was influenced by Ralph Lauren, whose stores reek of old-world WASP America. Lauren, by his own admission, has long been invested in selling a lifestyle, one that symbolises the American dream.

As Sabyasachi the label expands its tentacles into many more metropolises in India, his evident display of sentimentality only seems to grow stronger, which implies that the duality might be somewhat of a struggle, a form of inner conflict. Yesteryear, and scenes reminiscent of bygone eras, consistently seem to capture the imagination of the NIFT graduate who, at one point, also designed costumes for the silver screen. A montage of diffused images that bring to mind scenes from Shyam Benegal and Merchant Ivory films play on loop on his under-construction website. Black-and-white and sepia frames featuring coiffed women behind dark glasses — so maharani-like in their gait and manner, shown at ease playing pool in diaphanous saris, with their turbaned consorts — evoke mystery and intrigue. The only bit of text on the website reads: “Crowded narrow lanes with balconies jutting out of beautiful old mansions and homes, jostling for space in North Calcutta. So rich in its nonchalance, between the clamour of grandeur and decay. It’s almost spiritual, the neglect of luxury and the casual existence of glamour. It makes Calcutta unforgettable.”

Like his newly opened Mumbai store, ubiquitous Sabyasachi imagery persistently exudes heritage and grandeur, so typically suggestive of many old Kolkata homes that have filled the designer’s psyche since childhood. How could he have better expressed this? No wonder that the press release reinforces his hand in the creation of this majestic space: “Interiors and overall creative direction: Sabyasachi Mukherjee”. In the making of this Taj Mahal, Badshah Sabyasachi has shown a total engrossment with his whole self.

As the 25,000-plus-square-foot store dripping with chandeliers, antique wooden cabinetry, and stacks of crystal and porcelain recalls the times of the Raj and a certain post-colonial style interior, a staple in Mumbai’s Parsi-owned bungalows, one can tell that Sabyasachi also has a strong penchant for throwbacks and romanticising the past. How many modern-day Bengali brides are seen with their hands covered with the red stain of alta? But, we saw it in the brand’s Instagram posts in the second week of April. Donning long kurtas or wide triangular lehngas, with the typical stacking and mixing of gold-embroidered and brocade borders — “multimedia borders”, as the staff member had informed me during my tour of the store — most of the female models had their hands adorned with the red dye that is made from lac and traditionally applied on the feet during marriage ceremonies and festivals. No wokeism here, as we didn’t see it on the men.

For his Fall 2011 grand finale, nostalgia came from outside of his home state, from Mexican painter Frida Kahlo, as models strutted in braided hair, rose headbands, and wire-rimmed glasses. Sabyasachi’s Kahlo fascination has lingered on; I noticed many artworks of women with that famous unibrow, as well as coffee-table books on the painter whose autobiographical works often mixed realism with fantasy. Recently, The Times of India dated 22nd April showcased consecutive full-page ads of a medley of black-and-white clothing styled in a contemporary way, and one couldn’t help but think of Coco Chanel. Pussy-bow shirts and boxy jackets, paired with black-and-white saris, instead of skirts and trousers. Fashion can never be original as someone or something must come before. But the one thing that can be original is the designer’s muse, and for good old Sabyasachi Mukherjee’s mood board, despite his occasional departures, it remains the bhadralok gentry. (Apologies to Rani Mukerji here.) A quick giveaway was a book titled Elite Clubs of India, placed conspicuously on a shelf, under precious glass decanters.

Owning a Sabya lehnga or planning a Sabya wedding is no doubt a privilege among the already privileged. If you want to literally go the whole way, then zero in on “Sabya Red” too, a salesperson in black proudly states. Now, in addition to getting the largest flagship, Mumbai’s been gifted a refurbished neoclassical landmark in close environs of other historic buildings like The Asiatic Society of Mumbai and St. Thomas Cathedral. A 21st-century altar of aesthetic hedonism, straight out of the late 19th-century Decadent movement, for our own chattering classes.

As I walked out of the magnificent building, removed my spectacles and donned my sunglasses, was I caught in the ultimate Sabya moment. I stood still as if ensnared in a time warp. The bespoke Crimson Soil fragrance — another Sabya concoction — that permeates the store enveloped me as I stepped out into the grit of Mumbai.

Had I just successfully imbibed the Sabyasachi experience? Mood before product, experiencing the label back to front. I, too, was reminded of the decaying heritage homes of Kolkata, with colonnades, stained-glass windows, balconies with filigreed railings, and windows with wooden shutters. Stolid in past grandeur, frozen in heritage, these images of current decay had become indelible for me too, a “non-Bengali”, through films like Balika Badhu, 36 Chowringhee Lane and The Namesake that was adapted from the novel by immigrant author Jhumpa Lahiri.

Nostalgia imbues the Sabyasachi brand, and vice versa, the brand imbues nostalgia. No wonder many have referred to this larger-than-life store as a living museum.

It’s left to be seen if Mukherjee, the designer who did his early education at Sri Aurobindo Vidyamandir in Chandannagar, will find a unique contemporary language for the modern woman, mutated beyond his own inheritance of culture, and its currency. If he does, he will truly be leading the fashion pack from the front. He needs to draw from the same pluralistic heritage he often talks about in reference to the diverse hand-crafted techniques of India that his workshops around the country employ, be it ari, kashida, gota, kasuti, or chikankari, all of which are specific to certain regions across the nation. Calcutta Rouge, Nani Bucket, The Mangrove Bracelet, The Baghbazar Necklace, and the India Tote ring with romanticism, true, but there’s still hope that the “syncretic legacy of India”, which he wished for when he opened in New York, will be pushed further through his future clothing, jewellery and accessory collections.

The legacy is, undoubtedly, visible in each thread of zardozi, in each weave of Benarasi, each blot of indigo and each impression of block print. Today, however, this legacy and heritage need a 21st-century kalakaar (artist). Mukherjee did wish to introduce a certain “Indianness”; this was intentional, as his early days coincided with the period when post-liberalised India was beginning to embrace Western luxury, with the onset of brands like Louis Vuitton opening in tony areas of Bombay and Delhi. But, as a creator and designer, can Mukherjee blaze a trail, with greater and more frequent innovation, and give new meaning to decadence beyond aesthetic hedonism? Beyond the “patti-patti” look, which actually drew inspiration from the mixing and matching of clothing he observed on the streets and was, by 2011, turned into a template.

The limited New York edit I saw at the far end of the top floor, with its printed parrot green and rich salmon-coloured velvet co-ords hemmed with a black sequinned fringe, the rust-coloured “micro-kantha” trench and the oversized silk shirt dress with Kahloesque colours, are appetising for a woman who seeks freedom of movement and multiplicity of usage in her everyday wardrobe. But, only if he pushes the envelope further as a revivalist, providing that modern twist to the heritage techniques, will Mukherjee successfully bridge his two sides — the global and the regional.

It is this potential that I saw when I watched his first collection in 2002, at Lakmé Fashion Week in Delhi. So much so, that I had to have one of his patchwork brocade pants right after. Those who have known him from his nascent days wonder if his uber-nostalgia stemmed from something deeply aspirational as well. Instead of building his brand through the sheer weight of an eight-kilo lehnga or the might of the Tanjore paintings, Persian carpets, Tang Dynasty pottery, Canton vases and curiosity showcases he has personally sourced and amassed (a few under the aegis of the Sabyasachi Art Foundation), maybe Pepsi — Mukherjee’s daak naam (nickname) — needs to take himself a little less seriously as a tastemaker? For he has that certain je ne sais quoi that will stand the test of time.

The hot blue summer sky suddenly felt welcome as I left the dark, wood-panelled, air-conditioned environs, which barely showed a window. I instinctively shook my shoulders, as if to throw off the burden of trying to fully understand the deeper impact of culture. Did I just miss something that was meant to signify a Renaissance? Out of a habitual reflex, my eyes followed the uneven street in front of me, leading towards the Horniman Circle garden, originally known as Bombay Green. And I breathed out everything that I had been holding inside.

And soon, the honking from the street took over.